In today's fast-paced business surroundings, the ability in order to accept payments effortlessly is crucial to be successful. Whether you any small local go shopping or possibly a large ecommerce operation, partnering with a payment control agent can open significant growth probable for your organization. These professionals not really only facilitate purchases but also give invaluable insights in addition to services that can easily enhance your overall company strategy. With typically The Card Association reviews by the side, you may target on what a person do best—serving your own customers and driving your business forward.

Becoming familiar with the essential position of a payment processing agent is important for any enterprise trying to thrive on a competitive market. From navigating structure payment technology to be able to ensuring compliance together with industry regulations, these agents offer expertise that can help streamline your functions and boost earnings. In this article, you will explore the particular myriad ways repayment processing agents contribute to business good results and provide assistance with selecting the appropriate partner to your requirements.

Essential Functions of Payment Handling Agents

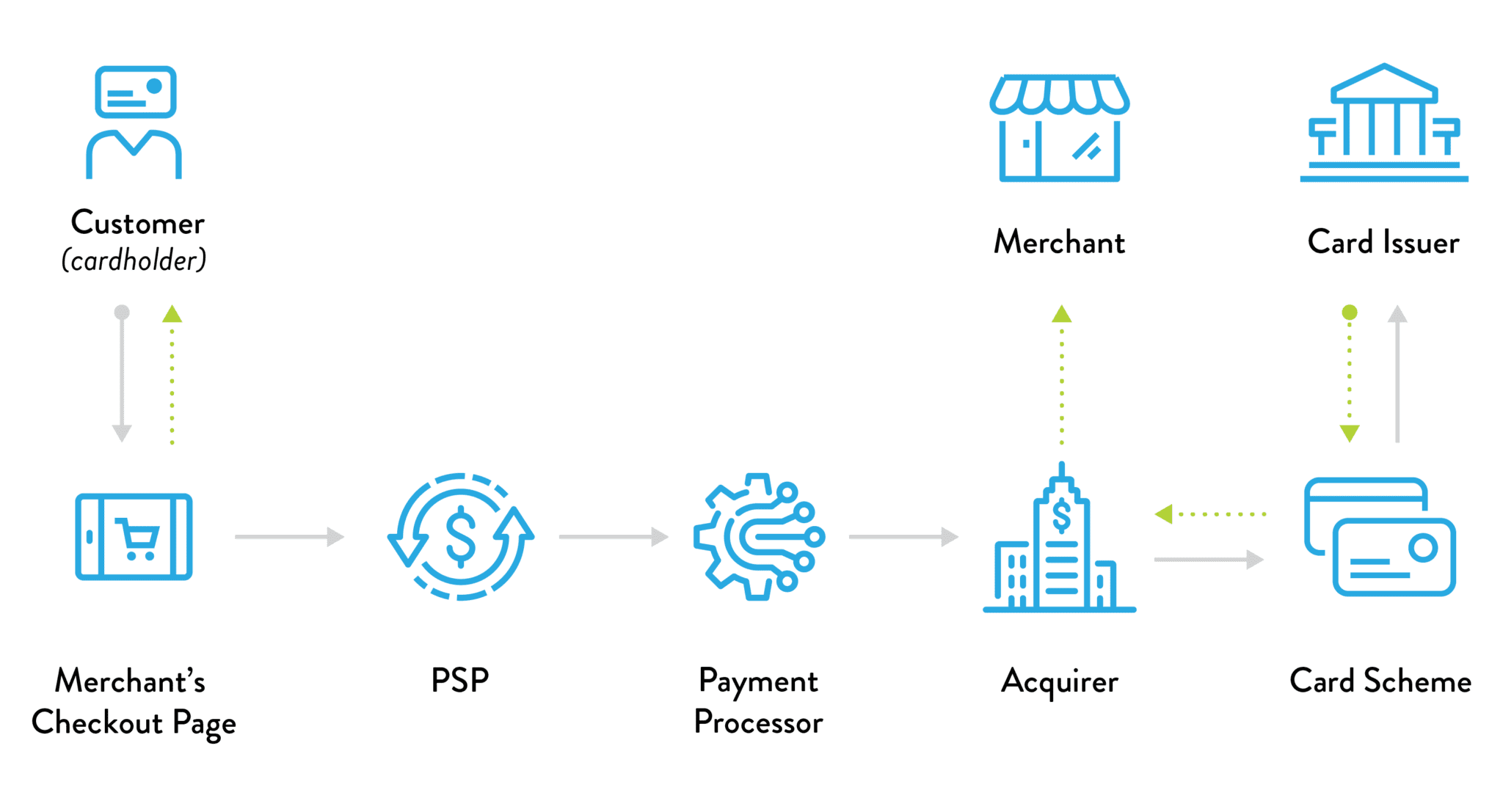

Payment processing brokers play an essential function in facilitating financial transactions between businesses and customers. Their primary function is to act as intermediaries, ensuring that will payments are prepared efficiently and safely. This involves reaching various payment companies, managing transaction data, and ensuring that funds are transported promptly. By dealing with these complexities, settlement processing agents let businesses to concentrate on their main operations while preserving an easy revenue circulation.

One other essential function involving payment processing real estate agents provides tailored solutions that meet the particular specific needs associated with businesses. They evaluate individual business demands and recommend suitable payment processing methods, gateways, and service provider accounts. This guidance extends to supporting businesses choose the right technology that will enhances the overall customer experience, rationalizes operations, and increases efficiency. By aligning to your different challenges regarding each client, payment processing agents engender a stronger relationship between businesses and even their customers.

Security is actually a paramount concern in today’s digital scenery, and payment processing agents are imperative in ensuring of which all transactions will be safe from scam and data removes. They help businesses understand and implement compliance measures, for instance PCI compliance, which often protects sensitive consumer information. Furthermore, transaction processing agents preserve abreast of typically the latest security tendencies and technologies, offering clients with valuable insights to guard their very own operations. This concentrate on security not just enhances consumer rely on but also supports long-term business expansion in a competitive marketplace.

Advantages for Small Businesses

Joining up with a settlement processing agent features small businesses many advantages that may significantly enhance their businesses. One of typically the primary benefits is usually access to a number of payment solutions that will fit their particular needs. Payment handling agents can supply tailored services that will allow businesses to accept multiple payment types, including credit score cards, mobile obligations, and online transactions. This flexibility makes certain that customers have hassle-free options, ultimately ultimately causing increased sales plus client satisfaction.

Moreover, payment processing agents often offer valuable insights straight into transaction data and customer behavior. Compact businesses can leverage these analytics to be able to make informed choices about inventory supervision, marketing strategies, and customer engagement. By simply understanding sales styles, businesses can enhance their operations plus better cater to their customers' preferences, fostering loyalty and inspiring duplicate business.

Another significant profit is the cost effectiveness that payment processing agents can provide to small businesses. They help negotiate better processing prices and terms, making sure that businesses are usually not overpaying with regard to their payment services. Additionally, agents can guide merchants inside choosing the perfect payment gateway in addition to merchant service provider, which often can bring about significant savings. With decrease costs and improved transaction management, smaller businesses can allocate even more resources to growth initiatives and customer experience enhancements.

Trends and even Future of Settlement Digesting

The payment processing landscape is quickly evolving, driven simply by technological advancements and even changing consumer tastes. One of the most significant general trends is the increase inside mobile payments, while more consumers opt for the convenience of using their smartphones regarding transactions. Payment processing agents must be well-versed in mobile repayment solutions along with the different platforms that help seamless transactions. This particular trend is not only concerning convenience; moreover it displays the broader shift toward contactless payments that gained traction during the pandemic.

One other major trend may be the growing emphasis on security and conformity. Using the rise inside cyber threats plus data breaches, organizations are increasingly concerned about protecting their customers' sensitive information. Settlement processing agents perform a critical role in helping businesses implement robust security measures, for example PCI compliance, EMV chip technology, and encryption. As regulations around files protection continue to tighten, agents need to stay informed regarding new requirements in order to help their clients navigate these difficulties effectively.

Looking ahead, the ongoing future of payment processing will more than likely see further the usage of artificial brains and machine understanding. These technologies could enhance fraud detection and streamline purchase processes, providing a new better overall working experience for both organizations and consumers. Settlement processing agents who else embrace these innovative developments is going to be better situated to offer value-added services and stay reasonably competitive in an ever-changing market. By focusing on emerging technologies and consumer trends, real estate agents can ensure they meet the innovating needs of their own clients.